Impacts on Markets and the Crypto Industry

The U.S. Federal Open Market Committee (FOMC) concluded its latest meeting on March 19, 2025, leaving the federal funds rate unchanged at 4.25% to 4.5%.

This decision, though widely anticipated, carries significant implications across various financial markets, including equities, bonds, and especially the cryptocurrency sector.

With global investors watching closely, the market’s reaction provides crucial insights into the economic landscape ahead.

This article delves into the broader economic impacts of the FOMC’s latest decision, examining how traditional and crypto markets are responding, and what traders and investors can expect moving forward.

Understanding the FOMC’s Decision

The Federal Reserve’s decision to hold interest rates steady comes amid mixed economic signals. Inflation, while moderating, remains above the Fed’s 2% target.

Employment data continues to be robust, but concerns over economic slowdown persist. The FOMC’s stance reflects a balancing act between maintaining price stability and ensuring economic growth does not stall.

The committee also released updated economic projections, suggesting that rate cuts may not materialize until late 2025. This signals the Fed’s commitment to taming inflation before making any adjustments.

Investors who were previously hopeful for a rate cut this summer may now need to reconsider their expectations, shifting investment strategies accordingly.

Stock Market Reaction

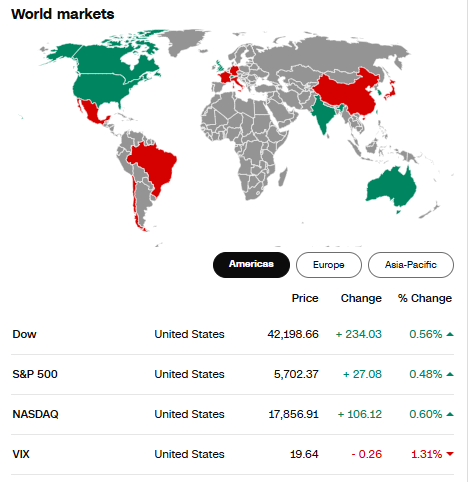

The U.S. stock market exhibited a mixed response following the FOMC’s announcement. Initially, markets showed volatility as traders processed the implications of the decision.

The S&P 500 and Nasdaq opened lower before stabilizing as Fed Chair Jerome Powell reiterated the central bank’s commitment to data-driven decisions.

Financial and banking stocks benefited from the stability in interest rates, as higher rates generally support better margins for lenders.

Conversely, technology and growth stocks faced some headwinds, as prolonged high borrowing costs may dampen future investment and expansion plans.

Bond Market and Dollar Strength

In the bond market, Treasury yields edged higher as investors priced in a prolonged period of elevated interest rates.

The 10-year Treasury yield climbed above 4.5%, reflecting market expectations that rate cuts may be further down the line.

The U.S. dollar also gained strength against major global currencies following the Fed’s decision.

A stronger dollar typically exerts downward pressure on riskier assets, including equities and cryptocurrencies, as international investors flock to dollar-denominated assets for stability.

Crypto Market Response: Volatility and Uncertainty

The cryptocurrency market, known for its high sensitivity to macroeconomic developments, witnessed notable price swings following the FOMC announcement.

Bitcoin (BTC) initially dipped below $90,000 as traders reacted to the Fed’s hawkish stance but later found support as investor sentiment stabilized.

Ethereum (ETH) and altcoins experienced similar volatility, with some digital assets facing double-digit percentage declines before recovering slightly.

The reaction underscores how cryptocurrencies remain highly correlated with broader financial market trends, particularly in response to monetary policy decisions.

Why Does the Crypto Market React Strongly to the FOMC?

Several key factors contribute to the crypto market’s sensitivity to FOMC decisions:

- Liquidity Flows: Higher interest rates make borrowing more expensive and reduce excess liquidity in financial markets. Cryptocurrencies, which thrive in liquidity-rich environments, often suffer when central banks tighten monetary policy.

- Investor Risk Appetite: Crypto assets are generally considered high-risk investments. When interest rates remain high, traditional investors may prefer safer, yield-generating assets like bonds and fixed-income securities over volatile digital currencies.

- Dollar Strength: A rising dollar can negatively impact Bitcoin and other cryptocurrencies, as many international investors use the USD to purchase digital assets. When the dollar strengthens, purchasing power for crypto weakens, leading to downward price pressure.

- Market Expectations: Speculative trading is a significant component of the crypto market. When investors anticipate a dovish Fed policy (rate cuts), crypto prices tend to rise due to expected liquidity injections. Conversely, a hawkish stance leads to sell-offs.

What’s Next for Crypto?

With the Fed signaling that rate cuts may be further delayed, the crypto market faces a period of heightened uncertainty. However, several factors could shape future trends:

After Bitcoin Halving (April 2024):

Bitcoin’s 2024 halving, which occurred in April, reduced the block reward from 6.25 to 3.125 BTC, effectively decreasing the rate at which new bitcoins enter circulation.

Historically, such halving events have been associated with significant price increases in the subsequent months.

Following the 2024 halving, Bitcoin’s price experienced substantial growth. By November 2024, it had surged to nearly $100,000, driven by factors including increased institutional adoption and favorable regulatory developments.

This upward momentum continued, and on December 4, 2024, Bitcoin reached an all-time high of $103,332.30. This post-halving price performance aligns with patterns observed in previous halving cycles,

Where Bitcoin typically experiences notable appreciation in the months following the event.

However, it’s essential to recognize that while historical trends provide insights, various factors, including macroeconomic conditions and regulatory changes, can influence future price movements.

Conclusion

The latest FOMC meeting has once again demonstrated how closely interconnected traditional and digital asset markets have become. While the decision to maintain current interest rates was expected, its implications for risk assets, particularly cryptocurrencies, remain profound.

As investors navigate the current landscape, understanding the broader macroeconomic environment will be crucial in making informed decisions.

While short-term volatility is likely, long-term crypto adoption and technological advancements could help digital assets regain momentum, regardless of the Fed’s monetary policy trajectory.

Traders should remain vigilant, adapting strategies to evolving market conditions while keeping an eye on key developments such as Bitcoin’s halving, institutional participation, and regulatory shifts.

The road ahead may be uncertain, but for those who position themselves wisely, opportunities abound in the ever-evolving world of crypto markets.

FAQs

1. How does the FOMC decision impact the cryptocurrency market?

The FOMC’s decision to keep interest rates steady affects liquidity and investor risk appetite, leading to volatility in cryptocurrencies like Bitcoin and Ethereum.

2. Why do crypto prices react strongly to Federal Reserve policies?

Cryptos are risk assets, and higher interest rates reduce liquidity, making investors prefer safer investments like bonds, which can lead to crypto sell-offs.

3. Will Bitcoin’s price recover despite the Fed’s stance?

While high interest rates may slow short-term growth, events like Bitcoin’s upcoming halving and institutional adoption could drive long-term recovery.

4. How does a strong U.S. dollar affect crypto markets?

A stronger dollar reduces global purchasing power for crypto, leading to lower demand and price declines for major digital assets.

5. What should crypto investors focus on after the FOMC meeting?

Investors should monitor macroeconomic trends, Bitcoin’s halving, institutional activity, and regulatory developments to adjust their strategies accordingly.